The Very Best Tips You Will Review Home Mortgages

Content written by-Cowan BennettWhen people think of mortgages, they often imagine pushy lenders and high interest rates. When you know a lot about the process of getting a mortgage, you'll find that these negative thoughts leave your mind completely. To learn all you can, read the content below which has been written by experts to provide you with the best advice available.

Prepare for the home mortgage process well in advance. If you want a mortgage, get your finances in order right away. That will include reducing your debt and saving up. Waiting too long can hurt your chances at getting approved.

Begin getting ready for a home mortgage well in advance of your application. If you're thinking about purchasing a home, then you have to get your finances in order quickly. This ultimately means that you should have savings set aside and you take care of your debts. If you put these things off too long, you could face a denial letter.

It's a wise decision to make sure you have all your financial paperwork ready to take to your first mortgage lending meeting. If you don't bring all the right paperwork, the visit may be pointless. The lender will require you to provide this information, so you should have it all handy so you don't have to make subsequent trips to the bank.

Always read the fine print before you sign a home mortgage contract. There are many things that could be hidden inside of the contract that could be less than ideal. This contract is important for your financial future so you want to be sure that you know exactly what you are signing.

Before talking to a mortgage lender, organize your financial documents. You will need to show proof of income, bank statements and all other relevant financial information. When you have these ready in advance and organized, then you are going to speed up the application process.

Some creditors neglect to notify credit reporting companies that you have paid off a delinquent balance. Since your credit score can prevent you from obtaining a home mortgage, make sure all the information on your report is accurate. You may be able to improve your score by updating the information on your report.

Chose a bank to carry your mortgage. Not all companies who finance homes are banks. Some of them are investment companies and private corporations. Though click the up coming article may be comfortable with them, banks are usually the easier option. Local bankers can usually cut down the turn-around time between application and available funds.

Think about your job security before you think about buying a home. If you sign a mortgage contract you are held to those terms, regardless of the changes that may occur when it comes to your job. For example, if you are laid off, you mortgage will not decrease accordingly, so be sure that you are secure where you are first.

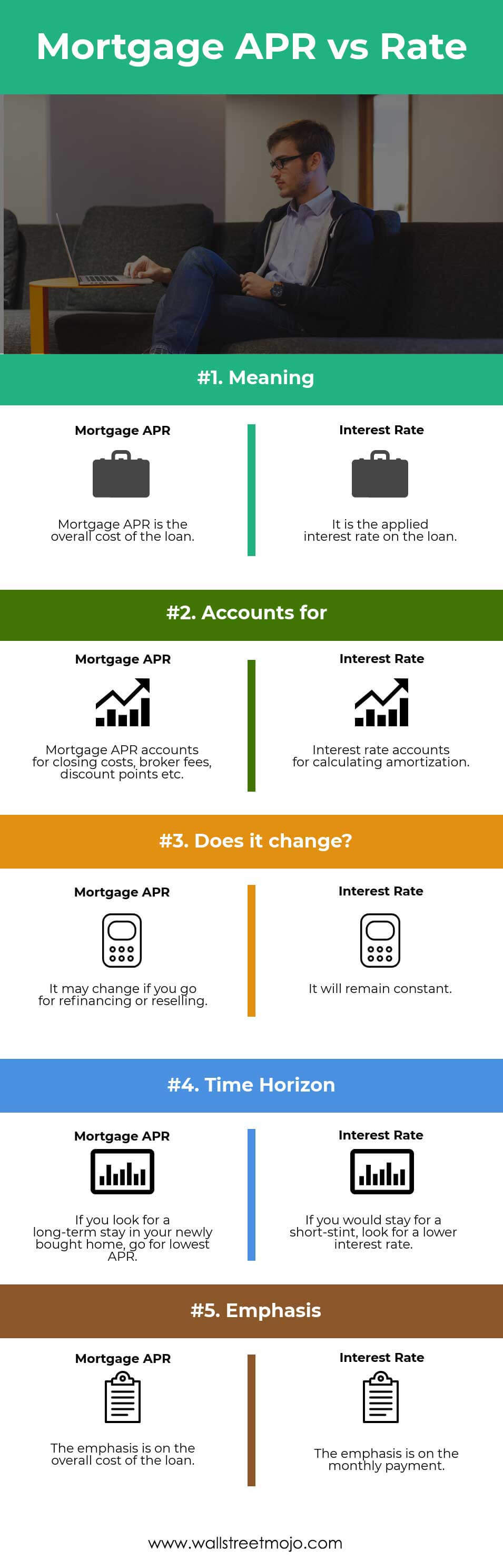

Keep an eye on interest rates. Although interest rates have no bearing on the acceptance of a loan, it does affect the amount of money you will pay back. Know about the rates and how they will change your monthly payment. If you don't pay attention, you could end up in foreclosure.

Many lenders now require a home to be inspected before the loan is approved. Although this costs a small amount of money, it can save you thousands in unknown expenses. If the home inspector finds problems with the home, you have the opportunity to either negate the contract or to renegotiate the sales price.

Be honest when it comes to reporting your financials to a potential lender. Chances are the truth will come out during their vetting process anyway, so it's not worth wasting the time. And if your mortgage does go through anyway, you'll be stuck with a home you really can't afford. It's a lose/lose either way.

Ask those close to you to share their home mortgage wisdom. They may be able to help you with information about what to look for. A lot of them could have had a bad time with lenders so that you know who you should be avoiding. When you talk to more people, you're going to learn more.

Before you contact a mortgage lender to apply for a loan to buy a home, use one of the fast and easy mortgage calculators available online. You can enter your loan amount, the interest rate and the length of the loan. The calculator will figure the monthly payment that you can expect.

Remember that there are always closing costs and a down payment associated with a home mortgage. Closing costs could be about three or four percent of the price of the home you select. Be sure to establish a savings account and fund it well so that you will be able to cover your down payment and closing costs comfortably.

Do not lie. When it comes to getting financing for a mortgage, you should never lie. Lying about your income or assets is not a good way to get a mortgage you can afford. This could land you even more debt that you cannot pay. Although it may seem wise to be untruthful in the beginning, it can cause problems later on.

Understand what happens if you stop paying your home mortgage. It's important to get what the ramifications are so that you really know the seriousness of such a big loan as a home mortgage. Not paying can lead to https://www.cnbc.com/2021/06/29/jpmorgan-is-buying-an-esg-investing-platform-in-banks-third-fintech-acquisition-of-the-past-year.html and potentially losing your home! It's a big deal.

Look online for financing for a mortgage. You no longer have to go to a physical location to get a loan. A lot of reputable lenders have begun to offer mortgage services online, exclusively. They have the advantage of being decentralized and are able to process loans more quickly.

With the valuable advice that has been discussed in this article, you're ready to jump out there and get going. The right mortgage is just around the corner. All you have to do is evaluate what is best for you with the criteria given. You will find yourself in a mortgage that makes you feel protected.